Everything to know about dividend imputation and franking credits

Have you ever heard the term in a finance news report, that a company is going ‘ex-dividend’ and is paying a dividend which is ‘fully franked’ or 90 per cent franked?

It may sound confusing, so here is everything you need to know, about dividends, franking credits and dividend imputation…minus the jargon.

What is a dividend?

Dividends are a payment made to shareholders from a company’s earnings, where the company has a policy of paying dividends. Not all do, but in Australia, it is more common than in other markets and usually occurs twice a year. These dividends are referred to as ‘interim’ and ‘final’.

And on occasion companies may even pay ‘a special dividend’ on the back of an asset sale or bumper profit. We’ve seen quite a few this year as companies seek to pass on franked dividends to their shareholders ahead of the Federal 2019 election and the prospect of a change to the taxation of dividends, if the Labor Government were to be elected.

What does it mean when a company ‘is going ex-dividend’?

The ex-dividend date is an important date. It is the date that investors must have purchased shares by, in order to be entitled to a dividend. Investors that purchase shares on or after this date will NOT be entitled to a dividend in the paying period and will have to wait for the next dividend payment.

A company’s share price may rise ahead of the ex-dividend date and then fall after the ex-dividend date, as it relates to the company transferring the dividend right to the shareholder and as a dividend is getting ready to be paid.

One business day after the ‘ex-dividend’ date or after a company goes ‘ex-dividend’, is the record date.

Record date

The record date is one business day after the ex-dividend date. It’s the date a company will close its share register to determine the shareholders that are entitled to a dividend. The register closes at 5.00pm.

The date payable is the date the dividend is paid to shareholders.

Cum dividend

This is the before the ex-dividend date. When shares are ‘cum dividend’, it simply means, when you buy shares in a company, you will be entitled to the recently announced dividend.

Once a company has declared or announced it’s paying a dividend, all the above necessary dividend data will be available.

Australian franking credit history

Before 1987 dividends were double taxed, i.e. the shareholder paid tax on their dividend(s), after a company had already paid tax on profits, which were issued as dividends.

Then in 1987, Australia’s 23rd Prime Minster, Bob Hawke, under the Labor Government with treasurer Paul Keating introduced one of the biggest tax reforms, the dividend imputation system. It ended the double taxation of dividends and distributions. The imputation system is explained below.

In 2000 our 25th Prime Minister, John Howard led the Liberal Government, with treasurer Peter Costello introducing a system that allowed investors to claim a franking credit tax refund, on the taxes paid by the corporate entity (on their dividends), reducing the amount of tax the shareholder had to pay.

Dividend imputation system

Australian residents are taxed under the system known as ‘imputation’. This is what late Bob Hawke introduced.

It is called an imputation system as the tax paid by a company may be ‘imputed’ or attributed to shareholders, by way of a franking credit, which is attached to the dividend. This is how the taxes paid by the company, at a maximum rate of 30 per cent, are allocated to shareholders.

Franked dividends

Only a tax resident company, or a New Zealand franking company which has elected to join the Australian imputation system, may pay or credit you with a franked dividend.

- Dividends can be fully franked (meaning the whole dividend carries a franking credit) or

- Dividends can be partly franked (meaning the dividend has a franked and unfranked amount)

Dividend and franking basic examples

E.g.1) In Woolworths (ASX:WOW) half-year report ending 30 December 2018, it declared it is paying a 45 cents per share dividend, fully franked. This means Woolworths is paying a 100 per cent franked dividend. As in it has paid all the company tax at a rate of 30 per cent.

E.g. 2) Whereas, AMP (ASX:AMP) advised in its 14 February 2019 update, it is declaring a final dividend of 4 cents per share, 90 per cent franked. This means the dividend comes with 90 per cent of the tax paid by AMP, at the company’s tax rate.

E.g. 3) In CSL’s (ASX:CSL) half-year report ending 31 December 2018 it highlighted it declared a final dividend of 93 cents unfranked, meaning the dividend has with no tax credit attached.

As dividends are deemed as ‘income’, the dividend paid/credited, is added to the investor’s assessable income. The dividend statement or distribution statement will include details of the payment made, along with the franking credits applicable and the amount of franked and unfranked parts of the dividend.

If a company pays or credits you with dividends that have been franked, you may also be entitled to a franking tax offset (explained below), for the tax the company has paid on its income.

The franking tax offset will cover or partially cover the tax payable on the dividends.

Franking credit tax offset

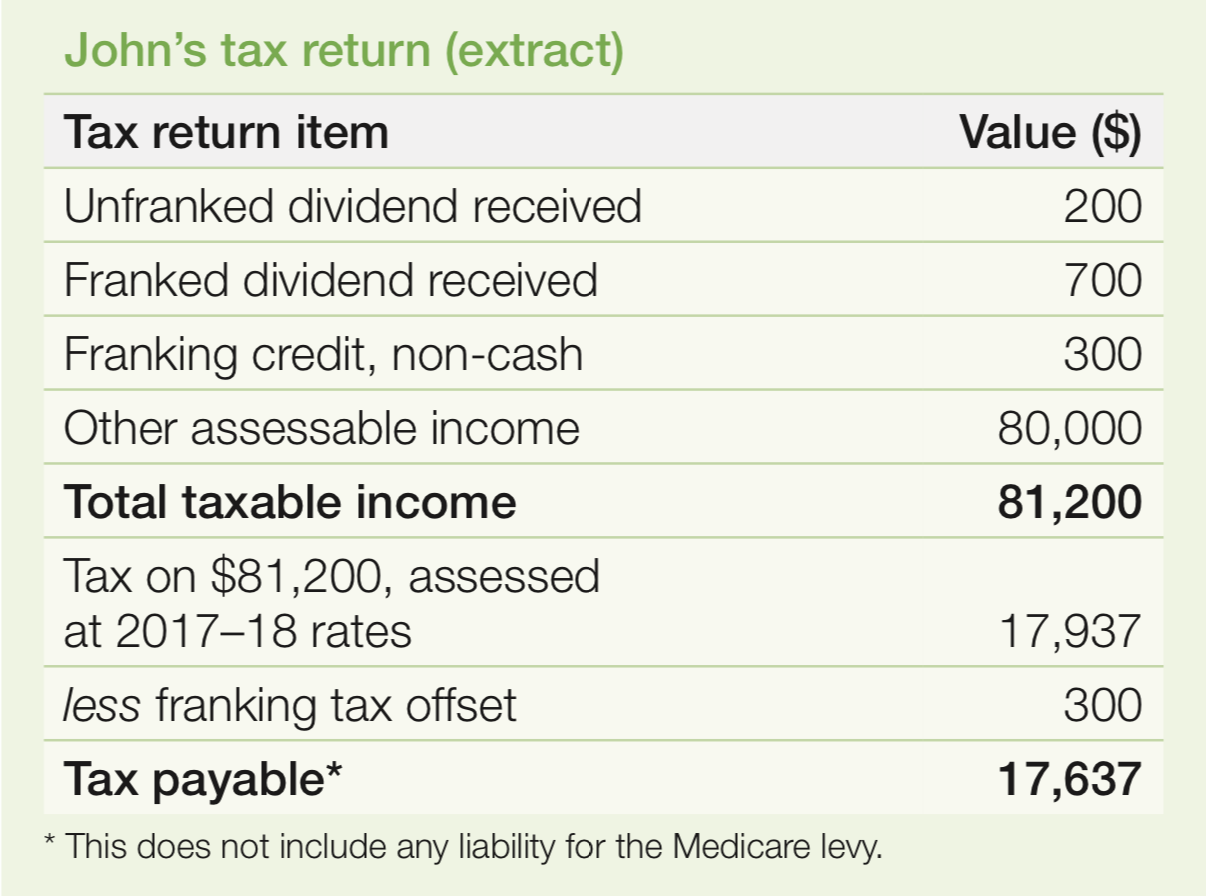

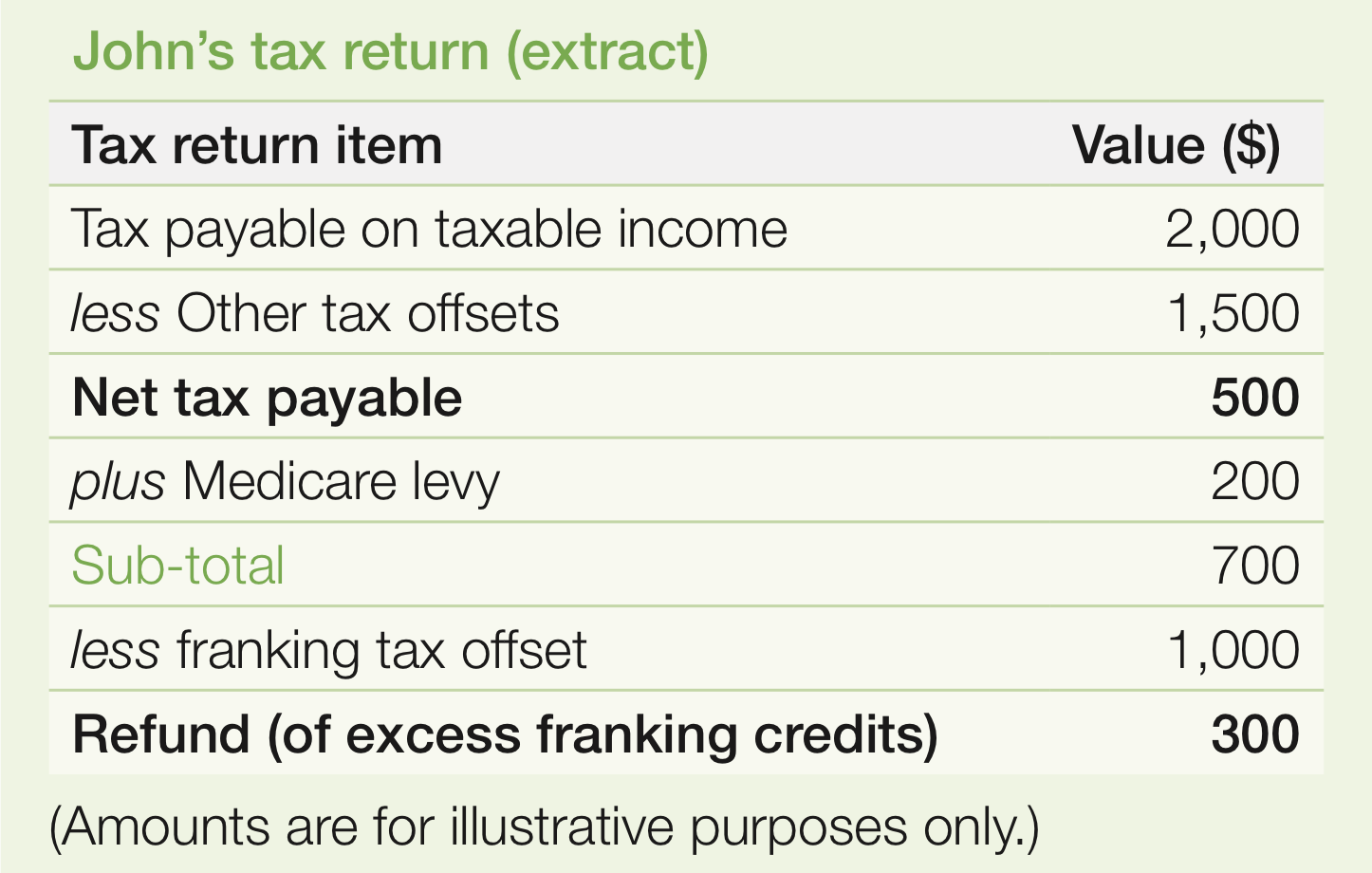

When you’re paid or credited franked dividends, you are entitled to claim a franking tax offset. Your assessable income will include the dividend(s) you were paid or credited, as well as the franking credits. Both amounts will appear in your tax return.

The franking tax offset can be used to reduce your tax liability, against all forms of income (not just on the dividend(s). The ATO’s example below shows how it works.

After income tax and the Medicare levy (levies) have been met, any excess franking tax offset amount will then be refunded to eligible residents.

Holding rule

To be eligible for the franking tax offset, investors must have continuously held shares for at least 45 days (or 90 days for certain preference shares), not including the day of purchase or sale.

However, if your total franking credit entitlement is below $5,000 (which equates to a fully franked dividend of $11,666), under the small shareholder exemption, the 45-day holding rule does not apply.

Unfranked dividends

In the above example with CSL, some companies pay unfranked dividends, where there is no franking credit. This is either because a company has not paid tax in Australia, as it’s offsets prior losses against a profit, or as the company’s revenue comes from overseas.

If you are paid an unfranked dividend by a foreign income company, you must include the amount as an unfranked dividend on your tax return.

However, as all dividends are deemed as income, necessary taxes will apply depending on the franking credits, as well as the tax offset which has been claimed. The payments will be added to the investor’s assessable income:

- If the shares are held directly, in your individual name, the tax will be based on your marginal tax rate

- If the shares are held in superannuation, the income is taxed at 15 per cent

- However, if the investor is in retirement phase (formerly known as pension phase), dividend payments are tax free* (*However, if an investor’s fund is over the $1.6 million cap, then tax will apply. The $1.6 million cap was introduced on 1 July 2017).

For more on the dividend imputation system click here

What labor planned if they had won the election

Bill Shorten planned to remove what he says is a ‘gift’, whereby ‘wealthier’ investors will stop receiving cash refunds for franking credits.

‘Labor will unwind the 2000 Howard Government decision that introduced cash refunds for excess imputation credits for individuals and superannuation funds’ according to the ALP.

Labor leader Bill Shorten said, “when you get an income tax cheque in the mail and haven’t paid income tax, it’s a gift”. And as Bill Shorten said on ABC’s Q&A Program, the ‘Labor Government is simply removing the gift.

If the ALP was elected, from 1 July 2019 Labor intended to reverse the concession created by Howard and Costello (in the year 2000), and ‘return to the arrangement first introduced by Hawke and Keating, so that imputation credits can be used to reduce tax, but not for cash refunds’.

This means the franking credit system and imputation would remain, but Labor intended to remove the franking credit tax offset. So, where investors up to now receive a cash refund for excess franking credits, this would no longer apply (if Labor won).

The Parliamentary Budget Officer (PBO), which provides independent, authoritative and non-partisan financial and economic analysis says, Labor’s policy:

- will not affect the vast majority (92 per cent) of individual taxpayers but

- it will affect around 200,000 SMSFs (out of the 600,000 SMSFs) – which equates to 33 per cent of SMSFs

The BPO says, “given most APRA regulated superannuation funds are typically not large beneficiaries of the current refundability arrangements this policy will have only a small impact on these funds. The policy will begin on 1 July 2019. This policy will save $11.4 billion over the forward estimates from 2018-19 and $59 billion over the decade to 2028-29”.

Despite the tax saving, 33 per cent of the SMSFs in Australia will feel impacted and this is something the Liberal Coalition Government has strongly opposed, with the current Australian Prime Minister Scott Morrison saying, ‘it’s the Opposition’s bid to “steal” tax refunds from the Australian Public’.

If the Labor party won the election and if its policy of scrapping the imputation credit tax refund was introduced – Labor says it would only apply to individuals and superannuation funds, and would not apply to bodies such as ‘endorsed income tax exempt charities’ and not-for-profit institutions (i.e. universities) with deductible gift recipient status.

For information on Liberal’s election policies, click here

For information on Labor’s plan to end cash refunds on dividends, click here

Written by Jessica Amir

16 May 2019

Amended 20 May 2019