2022 year in review:

2022 was a difficult year for most investors, as geopolitics and inflation took centre stage and forced equity markets on wild swings, and into a bearish trend. There was also significant hawkish intervention from all major central banks as inflation reared its ugly head after a decade of suppression. This included quantitative tightening sucking the liquidity out of the market causing a uniquely difficult equity and bond market environment in which both assets sold off in unison.

Investors struggled to hide as the total return from global stocks was -21% through the first 10 months of the year, with global sovereign bonds and credit showing high levels of correlation and returning -22% and -21% over the same time frame. We believe that markets look much better off on a medium to long time scale than they did prior to the sell-off and believe that a more dynamic approach to investment selection will be key to weathering the ever changing macroeconomic and geopolitical environment. As such, we have collated the 2023 investment outlook reports of all major investment banks and research houses globally to provide you with the predictions that they are congruent on, and some in which their opinions diverge to give you an understanding of how 2023 could play out.

We have tried our best to keep this report Australia centric where possible, but we live in a world where the U.S market and economy is the leading influence on market and asset performance and as such, a lot of what is discussed revolves around either global market data, or U.S centric statistics. These will all tie back to the influence on the Australia market so we don’t believe readers should be dissuaded or find any material to be of no use. There were two key themes that played out throughout the year discussed below:

Inflation and central bank intervention:

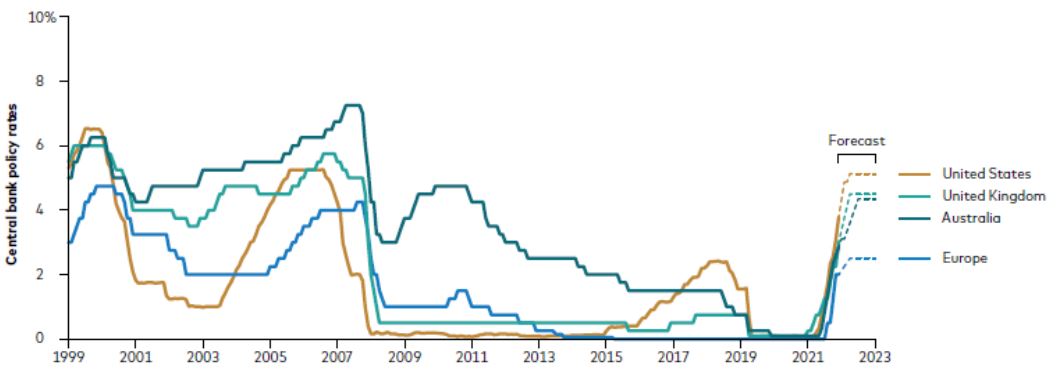

The figure below shows the collective monetary policy tightening that is unlike anything seen in the last 30 years on a global and coordinated basis. All major economies tightened monetary conditions together in unison to try to tackle inflation. Vanguard believes that there is equal supply and demand pressure contributing to inflation (supply comes from inefficiencies in the production of goods and commodities that forces the price up, whereas demand comes from consumer spending habits and need for goods and services). Monetary policy only has an influence on the demand side of the inflation equation as it reduces consumers propensity to spend, therefore the chances of a recession in most developed economies are high considering central banks will need to dampen demand to such an extent that it brings inflation within their 2% target range. This was predominantly negative for equity market returns across the board, in particular more economically sensitive sectors such as technology and real estate.

Deglobalisation, Geopolitics and Trade tensions:

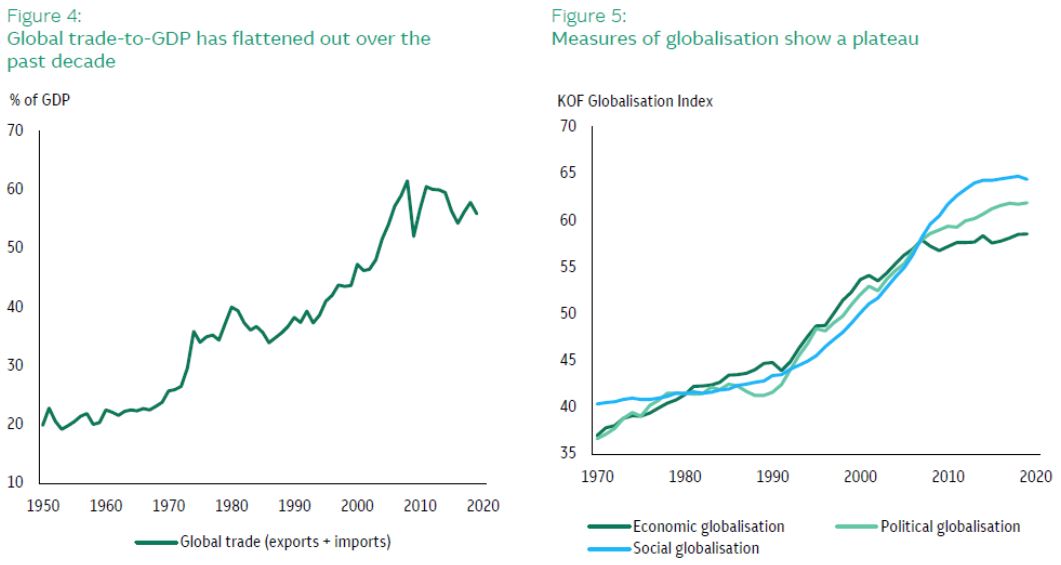

2022 was an inflection point in global trade and provided insight into what we believe will be a slow in international collaboration and trade. Reshoring (the processes of returning the production and manufacturing of goods back within a country) will be a key trend to watch over 2023 and beyond as countries look to shore up the reliability of their supply chains. Figure 2 shows that global trade of goods and services as a % of GDP peaked around 2008. There is a consistent message throughout all Investment Banks and research houses that trade will be closer aligned with political interests in the near to medium term.

There is also the expectation that defence budget spending will increase as a portion of government budgets, potentially expanding budget deficits further. Australia’s defensive budget as a % of GDP has slowly crept down from its highs in the 1960’s of 4% to 1.6% in 2013. This is set to change as the Australian labour government has voiced plans to increase this over the coming years to an average of 2.3% of the GDP. Although this isn’t a large change, the trend will be set for increased investment over the coming years.

What went well and what didn’t:

The 2022 market was just one of five instances where both U.S Treasuries and the S&P500 finished negative. It was a particularly tough year for investors that had larger exposures to economically sensitive sectors such as tech, communication services, real estate and retail. Alternatively, investors that took larger positions in healthcare, energy, solar and utilities most likely found themselves besting the market. Commodities were the strongest performing asset over 2022 with aggregated commodities indices averaging up 22% over the year.

What to look out for in 2023:

2023 doesn’t paint the rosiest of pictures but we believe that there are opportunities for a more active approach to portfolio construction and investment selection. We have highlighted some key themes that we believe will drive markets and asset performance in the new year.

The End of “Lowflation”:

Higher rates for longer is a consistent global economic trend that stemmed from 2022. This will most likely dominate the market for at least the first half of 2023 as global central banks continue to increase interest rates. The consensus suggests that we are in for a decade of structurally higher inflation after global free trade and low barriers to trade drove up competition for goods and services, driving down domestic pricing, keeping inflation at bay.

At least in the short term, it looks as though interest rates will continue on their upward trajectory as strong labour market and wage statistics is Australia and the US refuse to abate and will most likely show signs of cracking in the next few months. We are in one of those odd periods of time when bad labour market figures are actually positive for financial markets. Although inflation looks to be peaking, If the labour market remains strong over the coming months, central banks will have no choice but to keep increasing interest rates to drive down consumer demand to an appropriate level. This is largely negative to interest rate sensitive sectors such as technology in the near term as these companies are often valued off the present value of their future cash flows against the risk free rate.

There does seem to be light at the end of the tunnel as most Investment Banks believe that tech and small cap allocations should benefit from a pivot/pause in interest rates, and most forecast this to be mid to late 2023. We believe that investors should take a “cautiously optimistic” approach to economically sensitive sectors, and potentially look tobaverage into the market if we experience further pullbacks.

Energy transition set to push commodities onwards and upwards:

Commodities have been structurally underinvested in over the last decade and 2021-22 was a great couple of years for commodity investors. We believe that this trend will persist over the coming years as the energy transition and years of underinvestment force commodity prices higher.

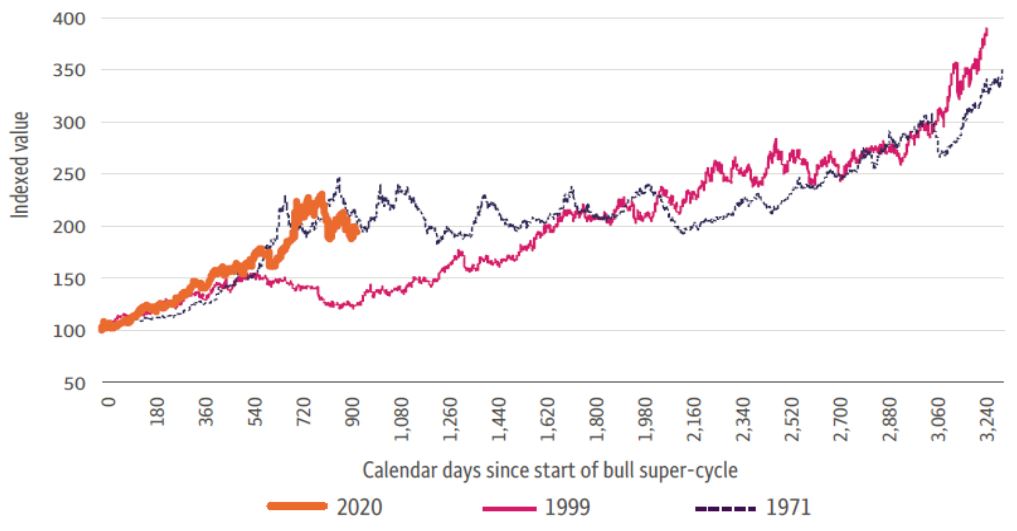

This is combined with dislocation in the commodities trading market due to deglobalisation, exacerbating the already stretched demand/supply dynamic. Commodity prices tend to move in large multi-year periods called “Supercycles” and are predominantly driven by demand changes putting upward pressure on low inventory and low supply. Figure 3 goes through 3 separate commodity cycles over a 9-year timeframe including large runs from 1971 and 1999 and suggests that this upward move in commodities could be sustained in over the long term (the orange line in the first 3rd of the chart).

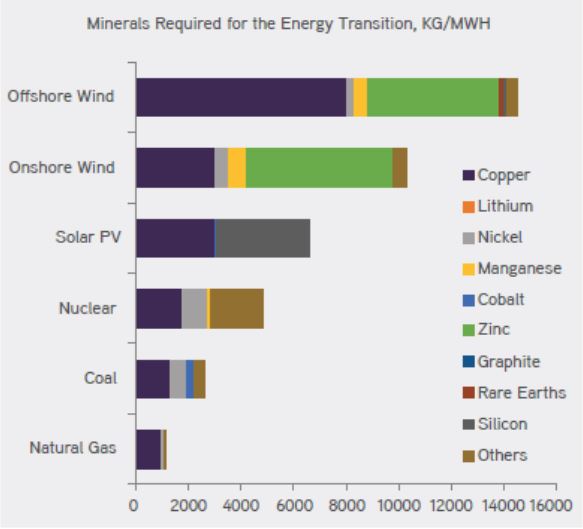

The commodity trend is driven by the global energy transition, with nations working towards meeting the 2050 net zero targets. KKR believe that the global energy transition is likely as big as the internet opportunity but points out a major difference between the two – “while the internet was a deflationary global force, the energy transition is an inflationary one.” This is congruent with the previously mentioned theme of a higher resting heartrate for global interest rates. They also point out that the bulk of lithium, cobalt and manganese refining is done within China, who have openly stated that they are transitioning from an export economy to one that has a self-sustaining economy.

All of these minerals are vital for the development of clean energy with the relative resource intensity displayed in figure 4. Investors with exposure to both base metals and minerals could benefit from an economic re-opening and the undersupply of key commodities. This also can act as a hedge against supply driven inflation influencing the pricing of goods. Most banks point to the fact that this transition will take many years, with most of the infrastructure to be built using traditional energy sources, so to not count them out of the equation from an investment perspective baring ethical concerns.

Equity markets, a tale of two halves:

Inflation figures are currently driving equity market direction, but we believe the prospect of decreasing corporate earnings and margin pressures could take over and move markets lower in the near term. Fixed costs and wages tend to be sticky upward and although demand has still yet to abate, global equity markets for the first half of 2023 will start revising forward estimates down as demand starts to slide whilst costs remain high. We believe that investors should be cautiously optimistic that a period of negative GDP growth could be short lived, and that a mid-year interest rate pivot by central banks could spark a new wave of market optimism, especially in economically sensitive sectors.

In the first half of 2023, sectors with low leverage, pricing power and stable earnings will most likely outperform. We believe that the markets favour Industrials (including those involved in defence), Energy, Healthcare, IT and Consumer staples. These industries typically exhibit stronger pricing power and higher market concentration. This means that these sectors are typically dominated by larger companies that have high market share and have the ability to pass costs on to customers without significant impact on their margins and earnings.

In the second half of 2023, there is a distinct consensus that once major central banks reach “peak hawkishness” and pause interest rates, the outlook for more interest rate sensitive sectors such as technology and real-estate should offer better opportunities for

growth. We believe that a more active approach to portfolio construction can serve investors well throughout this period.

Healthcare specifically looks to benefit from continued changes in the aging population. The increase in the population reliant on healthcare services such as medical technology, robotic surgery and diagnostics is growing and their ability to spend on goods and services is buoyed by them holding the majority of global wealth.

Energy transition is a consistent positive thematic share by all investment banks. Macquarie anticipates $US2 Trillion in global inflows over the next five years, with the US setting aside $US369 billion in climate investment. In the EU, the Ukraine Russian war has accelerated many EU nations drive for renewables in order to be less reliant on Russian Oil and Gas. This also supports our views on key commodities experiencing fractured demand/supply dynamics due to the resources needed to build clean energy infrastructure and technologies.

The “income” is back in fixed income:

Higher interest rates could lead to greater opportunities for income investors looking for consistent yield. Low interest rates have pushed investors up the risk curve towards equities as bonds and term deposits didn’t generate a sufficient return both in nominal and real terms (after considering inflation). The market has changed in the last half year, with interest rates and yields increasing substantially over the last calendar year and the prospect of structurally higher interest rates and inflation subsiding, real yields could see investors satisfied with high grade bond exposure, money market fund instruments, or even term deposit exposure providing them with a satisfactory return. For income investors with a higher inclination for risk, ASX listed instruments can offer yields of upwards of 8.5% for those willing to take on higher default potential. As always, its best to speak with an Investment Manager before making these decisions.

Where to from here?

Navigating the markets is hard, even at the best of times. At Sequoia Asset Management, we are constantly working to provide our investors with the best investment opportunities in any market cycle. If you have any questions about the material provided in this document, or wish to discuss these topics in further detail, please don’t hesitate to contact us on invest@sequoia.com.au or call 02 8114 2222.

Investment bank outlook reports referenced:

Credit Suisse 2023 outlook:

https://data.stagingmag.nl/2763/issues/39432/494150/downloads/2209270_cs_io_2023_en_rgb_digital.pdf

Wells Fargo 2023 Outlook:

https://saf.wellsfargoadvisors.com/emx/dctm/Research/wfii/wfii_reports/Investment_Strategy/outlook_report.pdf

Vanguard 2023 Outlook: https://www.vanguard.com/pdf/ISGVEMO_122022.pdf

UBS 2023 Outlook:

https://www.ubs.com/global/en/assetmanagement/insights/investment-outlook/panorama/panorama-end-year-2022/articles/calm-waters.html

KKR 2023 Outlook: https://www.kkr.com/sites/default/files/2022-December-Outlook-for-2023-Keep-It-Simple.pdf

JP Morgan 2023 Outlook: https://am.jpmorgan.com/content/dam/jpm-amaem/global/en/insights/market-insights/Investment%20Outlook%20for%202023.pdf

Macquarie Asset Management 2023 Outlook:

https://mim.fgsfulfillment.com/download.aspx?sku=OTLK-REPORT-2023

Appendix:

Defence Spending data:

https://data.worldbank.org/indicator/MS.MIL.XPND.GD.ZS?end=2021&locations=AU&start=1960